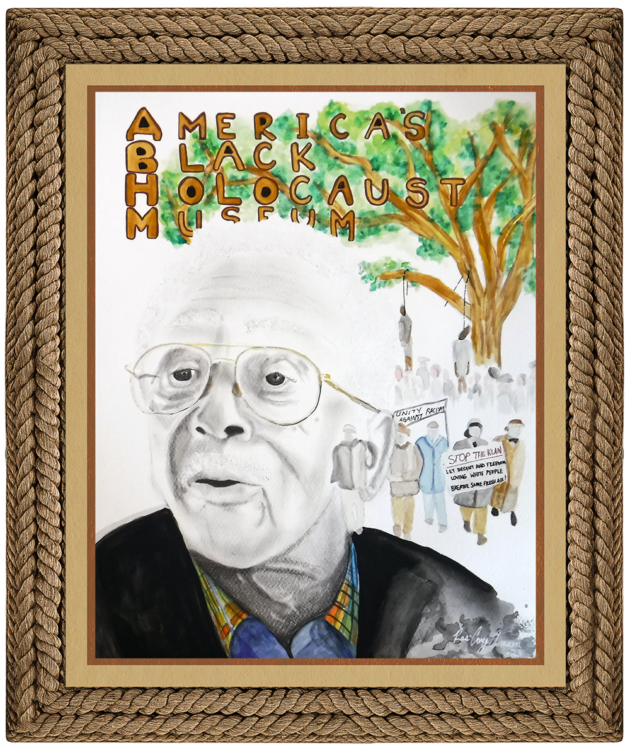

Breaking Down Racial Barriers in Real Estate

Share

Explore Our Galleries

Breaking News!

Today's news and culture by Black and other reporters in the Black and mainstream media.

Ways to Support ABHM?

By Oscar Perry Abello, Yes Magazine

The real estate industry has long had a Whiteness problem. An emerging Black developer in Baltimore is challenging the state to help fix the appraisal gap and other injustices.

Bree Jones rolls deep. Her nonprofit real estate firm, Parity Homes, has a buyers collective of 60 households. They have all gone through a proprietary six-month curriculum Jones built from scratch, covering everything from financial planning to maintenance, community building, and the history of redlining—and how those factors continue to shape the Baltimore neighborhood where they all want to buy homes.

“It’s about building an intentional, mission-driven community,” Jones says. “We talk about common principles—anti-gentrification, the importance of shared cultural assets, green space assets, things that aren’t part of our common dialogue in America anymore. Older generations did it in the 1940s, ’50s, ’60s.”

Jones says her buyers collective members have all come through word of mouth so far. She talks about her work everywhere she goes—like volunteering with a local church, where a pastor’s family is now part of her collective. Some are from the area of West Baltimore where Parity Homes is focusing its work; others are originally from the area but moved out when they were teens and now want to move back.

Parity Homes keeps an architect on retainer to help buyers select one of six floor plans for Baltimore’s signature row houses. Options include splitting the home into a two-flat to create some extra income for the homeowner and another affordable housing unit. Three buyers collective members have made their selection, and Jones hopes to deliver their homes later this year, hopefully by July.

“They call me every week [to ask] how’s the house coming along,” Jones says.

For all that Jones has made possible so far, it’s not yet sustainable. For now, Parity is selling the homes for less than what the firm has paid to acquire them. That’s because the homes suffer from the appraisal gap, which disproportionately affects historically Black neighborhoods. After generations of disinvestment, which started with redlining in the 1930s, the homes today require significant rehab, the cost of which can far exceed the values that the homes will appraise for, even after rehab.

Some help may soon be on the way. Last year, Maryland state legislators passed a bill to create the Appraisal Gap From Historic Redlining Financial Assistance Program. Jones says it started with a conversation between her and Maryland Sen. Antonio Hayes.

Discover how funding for this program will help house black people.

Related articles about a Chicago suburb that has given reparations to survivors of redlining, how modern redlining still happens, and why legislation changes aren’t enough to level the playing field.

Following housing and other racial justice topics on our breaking news page.

Comments Are Welcome

Note: We moderate submissions in order to create a space for meaningful dialogue, a space where museum visitors – adults and youth –– can exchange informed, thoughtful, and relevant comments that add value to our exhibits.

Racial slurs, personal attacks, obscenity, profanity, and SHOUTING do not meet the above standard. Such comments are posted in the exhibit Hateful Speech. Commercial promotions, impersonations, and incoherent comments likewise fail to meet our goals, so will not be posted. Submissions longer than 120 words will be shortened.

See our full Comments Policy here.